Benefits of Tokenization

The tokenization of assets is revolutionizing the financial industry and changing the way investors trade and manage assets. Until now, investment opportunities in the solid real estate sector have been restricted to accredited investors, real estate developers and businesses.

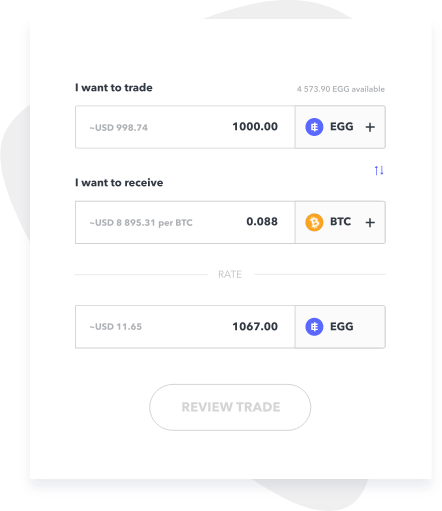

Swap your assets

Possibility of exchanging assets (materialized by tokens) 24 hours a day and with the whole world. We connect you to thousands of other investors on exchanges like Uniswap, Kyber, or 0x.

Minimal entry tickets

The minimum entry ticket can be around $ 10 on each project, this is due to the savings achieved through the management and distribution of funds on the blockchain. This opens up prospects for liquidity.

Distribution automation

If the fundraising is successful, you automatically receive your real estate tokens and then your dividends in the form of $DAI. The real estate administrator will see his task lightened and overhead costs are therefore reduced.

Governance

Stay safe by having your say at every stage of the project you have invested in. Keep an eye on every aspect of the project with the increased transparency of blockchain.

Keep your income on the blockchain

Your income stays on the blockchain without fluctuating, you can only convert it when you want to use it on a daily basis.

Meet the world by

tokenizing your property

Tokenize Property

Select your Package

Grab advices from our experts before moving forward.

Try for free.

FUNDS

LISTING + WHITE PAPER

Regular

- Fundraising Page

- White paper Drafting

- Escrow Management

- Customer Reports

- Transaction Reports

- Automatic Accounting Services

- Keep your Fundraising Private

PROPERTY OWNERS

LISTING + WHITE PAPER + ADVISORY + MARKETING + JOIN VAVE REIT

Exclusive

- All REGULAR LISTING services are included

- Funding Introducer

- Inbound Marketing Services

- Outbound Marketing Services

- Shared with a +50K community

- Legal Audit

- Financial Engineering Advisory through Vave's Networks & Communities

- Dividends Distribution Smart Contract

- KYC Whitelist Smart Contract

Your Real Estate traded all over the World !

Tokens of your company owning Real Estate are now represented by tokens and can therefore be traded on global exchanges such as Vave upcoming Dex or Uniswap.

1 Company Share = 1 Token.

Your Real Estate

Tokenization starts here

Grab advices from our experts before moving forward.

TOKENIZATION SERVICES

- ERC20 Token Primary Issuance

- Secondary Market Connection

- Escrow Management

- Dividends Distribution Smart Contract

- Customer Reports

- Transaction Reports

- Funding Introducer

- Inbound Marketing Services

- Outbound Marketing Services

- Automatic Accounting Services

- Club Deals Privatisation

- Fundraising page

- White Paper Drafting

- KYC Whitelist Smart Contract

- Legal Audit

FAQs

How often do I receive my dividends?

You can cash out your dividends at any time, based on successful fundraising. A minority of projects, however, require a later distribution date, communicated accordingly. You can track and withdraw your dividends from your Vave profile.

What are the payment methods?

You will pay for your shares with Cryptocurrencies, Fiat or Transfer to the partner notarial firm "Alpha Notaires" (or in some cases the notary assigned by the property manager carrying the transaction) who will secure your deposit over the duration of the Fundraiser. Decentralized fundraising will occur on our partner's portal: https://airdao.io and will only accept $DAI as a payment method.

In the event of a resale of its tokens, what is the resale rate based on?

The token rate will be based on supply and demand on decentralized trading platforms such as Uniswap, Kyber, Matcha or Balancer.

In the case of a purchase requiring renovation or work, who is responsible for the execution, site monitoring and payment?

The property manager carrying the project or the architect, the costs are the responsibility of the SAS carrying the property and managed by the Property Manager.

If the tenant terminates, how does the rent-free step go, who handles this situation?

The Real Estate Manager's mission is to find a new tenant as soon as possible.

The yield of +9% sometimes mentioned does not include the added value of the property on resale?

The yield mentioned represents your annual dividends, the real estate asset that you have bought can lose or gain in value on DEXs (decentralized exchanges).

Am I liable if my co-shareholders are linked to fraudulent activity?

No fraudulent activity is accepted and we ensure the careful verification of each file. You are not responsible for the activities of your associates as stipulated in the articles of association that you have signed or will have to sign as a shareholder.

What is the role of property managers?

A real estate manager is an individual or a company that allows you to have nothing to manage on your real estate investments. He finds, shares and manages property like a real estate agent with no training required. Vave is a social network allowing you to follow the investment activities of real estate managers privately.

Why do I have to be accepted into the network of a real estate manager to participate?

Vave is a private club deals platform, therefore the projects presented can only be opened to members of the manager's network.

What are my risks when investing?

The goal of the Vave team is to make a careful selection of different projects to make sure that you only invest in quality programs. However, any investment involves risks, we have listed for you the risks that you bear as an investor:

RENTAL RISK An extended vacancy of one or more lots would reduce the return on the investment. WORK RISK During the duration of the project, unscheduled work may need to be carried out INSURANCE RISK The insurance taken out could not fully cover damage to the property.

CASH RISK: The available cash could be insufficient to meet the commitments. REAL ESTATE RISK The total or partial destruction of the building could cause a loss of the investment.

LIQUIDITY RISK: A partner wishing to sell his shares may not find a buyer.

What is the tax for this type of income?

In France, since January 1, 2018, dividends received by a taxpayer are automatically taxed at the single flat-rate deduction of 30% (“flat tax”). Vave is therefore required to withhold this 30% withholding tax at source and remit it to the State. This deduction is in full discharge and the amount of the net dividend received by the investor will be net of tax.

However, the investor can request, on express option, the taxation of his dividends at the progressive scale of income tax, which may prove to be interesting for a taxpayer taxed at the first brackets of the tax scale. on income.

Arbitration will have to be made by the investor in this regard. Non-French participants are invited to do their own research in their respective countries.

Is it possible to lose more than your investment?

No, by investing through a simplified joint stock company, you cannot lose more than the amount invested. The liability of SAS partners is limited to their respective contributions.

Can a company invest?

Yes, it must then provide different documents: identity document of the manager, a Kbis (or incorporation certificate for companies that are not french) dated less than 3 months, as well as the identification documents of the partners holding more than 10% of the company. Contact us for more information.

Contact

Fill your email and a representative

will get back to you shortly.

English

English  French

French