What is asset tokenization

The tokenization of assets on the blockchain is quickly becoming the hottest trend in financial markets as previously unavailable investment sectors open up to small investors. How is this possible and what is the tokenization of assets? Keep reading to find out!

Imagine you have an expensive and unique item that is difficult to sell, such as a legacy piece of art. These assets are considered illiquid because they require time and resources to be sold to the right buyer at the right price. To release your cash, i.e. sell the artwork, you need to find an interested art collector who has enough funds to purchase it in full.

Obviously, there won’t be many people who meet these criteria and therefore you won’t be able to sell illiquid assets quickly; not without significant loss. But what if you could digitize and divide your real estate or artwork, and sell parts of it to people all over the world, like selling shares in a company? Maybe you could only sell part of it, enough to get the fund you need now?

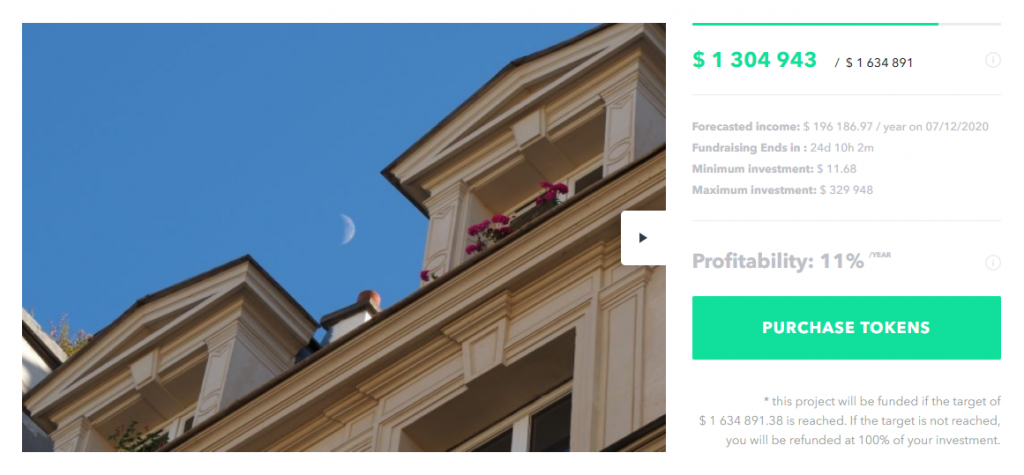

Let us take another example. The real estate sector remains one of the most stable and profitable investments despite the crisis of 2009. And yet anyone wanting to reap the benefits must invest substantial sums to purchase the entire house, plus transaction costs and costs. notary fees. You can’t invest a few thousand dollars in just a square meter or two, nor can the owner sell you only a small part of their house. Or can they?

Tokenization of an asset is the issuance of digital tokens that represent ownership of an asset, such as a work of art or a house. Instead of looking for a local buyer interested in a rare or expensive item, asset owners can sell their assets symbolized – IEO or STO to many small investors worldwide, in whole or in part, in various customizable contractual conditions .

At the same time, retail investors can enter markets previously reserved for large players and seize lucrative opportunities at a low minimum investment threshold and negligible transaction costs.

How does asset tokenization work?

Blockchain technology is primarily known for trading bitcoin and cryptocurrency. However, it has many real-life applications from delivery system management to asset tokenization.

The blockchain is a time-stamped, immutable digital ledger, which means it is tamper-proof and can be eternal proof of a transaction. For the purposes of this article, we are focusing only on decentralized public blockchains as they are at the heart of the blockchain movement and the Vave’s philosophy.

Using pre-designed smart contracts, we can embed information into the blockchain, in this case the details of asset ownership. While it may seem daunting, the process can be as easy as a few clicks when using middlemen. Most tokenization portals include not only scanning and token issuance services with carefully audited and standardized smart contracts, but also access to asset exchanges and a global network of investors, allowing exchange of information. ‘instant assets 24/7.

What Can You Tokenize?

In essence, you can symbolize almost anything from a real-world object to your virtual objects, and maybe even your own work or future ideas, as long as you can create a legal representation of the property of these assets.

In practice, tokenization is more useful for traditionally illiquid assets such as high-priced real estate, works of art and collectibles, or materials sold in traditional markets in extremely large lots, for example, base metals.

Tokenization allows for the divisibility of substantial assets which can then be sold in part or in whole to various small investors.

Is tokenization safe?

Almost anyone can symbolize assets or buy tokens online, but the question is how to ensure that digital tokens represent real assets. At this point, we still need trusted third parties Vave and their Legal Team, to audit asset ownership and ensure tokens are backed up.

As with everything, it is prudent to always do your due diligence and ensure that the platform you are using offers existing assets and compliant trades, for example, through KYC / AML vetting of investors.

Buying and trading tokens on external exchanges or secondary markets comes with a set of risks, and you need to keep your passwords and secret keys safe to maintain access to your assets. In the blockchain, your asset is not attached to your identity per se but to your account held by a private key, so the loss of keys can mean the loss of assets.

Legality of contracts and administrative formalities

Most tokenization portals, including Vave, offer bespoke smart contracts audited by an expert legal team. Our team also checks the legal documents related to the ownership of the asset, to ensure that the owners have the right to symbolize and sell their items.

In your digital wallet, the token is a representation of ownership of your asset, with the contract terms encoded.

Additionally, at the time of purchase, the transaction between you and the seller is time stamped and integrated into the public blockchain and serves as further proof of your asset ownership until you sell or trade.

Tokenized assets must comply with local regulations in many geographic jurisdictions, as tokens are sold to investors around the world. Terms of sale are often included in smart contracts and tokens as some investors may be excluded from the purchase due to their local laws i.e. US citizens.

Advantages of tokenization / Advantages

For asset owners:

- Unlock illiquid and hard-to-sell assets.

- Get instant access to 24/7 trading and a global network of investors.

- Divide the assets and sell a fraction of the property.

For investors:

- Access high performing industries with a low barrier to entry.

- Trade assets quickly and with low transaction fees.

- Buy a fraction of the high priced items.

Tokenization negatives / Cons

- Tokenization requires document audits on third-party assets.

- Ownership is linked to your online credentials (i.e. private keys) rather than your personal identity.

- Assets lost through phishing or the loss of private keys are often unrecoverable.

English

English  French

French