Real estate is among the highest return and lowest risk investments. Even factoring the 2009 housing crisis, the real estate sector outperformed the stock markets (S&P 500) over the past 20 years, with an average annual return between 9,5-11,8%, depending on the type of properties vs. only 8,6% for stocks.

Since purchasing properties requires significant capital, only larger institutional and corporate investors or developers can truly benefit from real estate opportunities and use properties to diversify their portfolios. Just stop for a second and imagine how much an investment portfolio must be worth if only one of the assets is priced at 250k+ euro, excluding fees.

Direct real estate investment is beyond the abilities of an average private investor. Still, retail investors have some indirect access to the housing markets through financial instruments like trusts and funds, for example, REITS (Real-estate investments trusts) and ETF (Exchange-traded funds). Trusts offer access to already designed and optimized portfolios of mixed properties. Investors and traders who use REITs and ETFs can’t own the underlying assets or pick specific residences.

Real estate tokenization offers smaller investors an ability to purchase, own, trade, and exchange pieces of property of their choosing.

How Does it Work / How Does Real Estate Tokenization Work?

Real estate tokenization is a process of creating digital tokens that are backed by real estate assets. Similarly to how companies issue shares, a house can be represented by a number of tokens, usually chosen by the house owner. This way, a property can be divided and sold to various smaller investors worldwide.

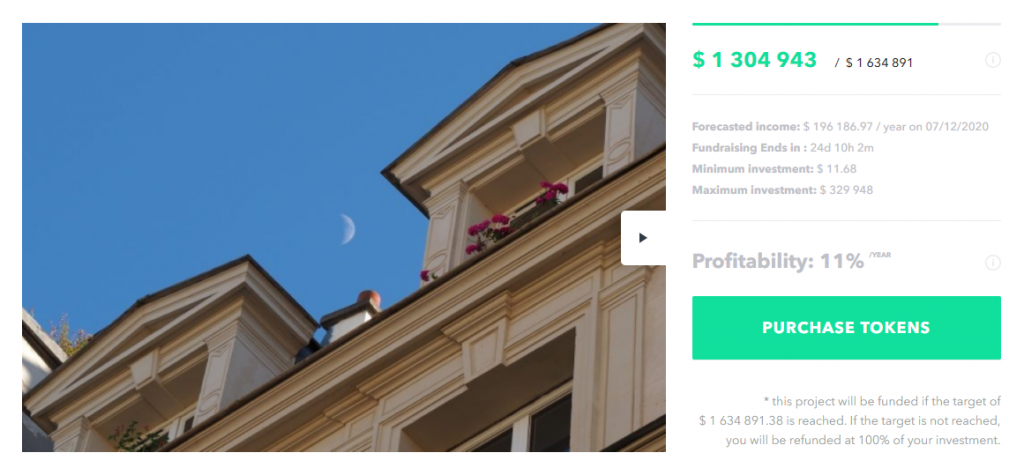

Just imagine, you can go to a website right now and purchase 1k euro worth of someone else’s home with just a few clicks. Take a moment and think of your dream location and a house that you’d like to get.

Now, check the list, pick your favorite real estate, and invest as much as you want. Done.

You’ll instantaneously receive proof of ownership, and depending on the contract conditions, you may gain dividends from mortgages and other property income.

Digital tokens are encoded with the contract conditions and thoroughly vetted by legal teams and developers during issuance. When you buy a tokenized asset through a website, the underlying transaction is executed on the blockchain and serves as an unchangeable record and your proof of ownership. You can also instantly see the real estate tokens in your wallet.

Blockchain Immutability

The blockchain technology revolutionizes transactions and contracts in the sense that trusted third parties like attorneys, notaries, governments, and corporate intermediaries are no longer necessary.

Thanks to inherent blockchain characteristics, like decentralization, immutability, and timestamping, the transactions executed on the blockchain are infinitely more secure and error-proof than the traditional paperwork.

Blockchain immutability means that anything submitted to the blockchain through transactions cannot be changed. The transactions are always timestamped and transparent, allowing for easy tracking of asset ownership. Blockchain decentralization is essential to its immutability. Decentralized blockchains are stored on millions of individual machines worldwide, guaranteeing that the records can never be deleted or changed by a central entity.

The legal audit is still crucial to confirm the real estate existence and ownership during the tokenization process. Many platforms, including Vave, offer full real estate tokenization services with standardized smart contracts, customizable tokens, and legal advice. Once tokenized, the real estate can be legally traded and exchanges on public exchanges and secondary markets, just like other virtual assets and cryptocurrencies.

Shared Property Management

Purchasing a part of the house with other investors allows you to obtain a voting power and access to shared property management. Just like the stock owners can vote on the future of the company, you can have a say in how your property is managed.

When investing in real estate through Vave, you can find conditions of contracts in the listing description. Upon investing, you gain access to an easy and intuitive dashboard where you can vote on the major property management decisions.

Dividends and transactions

Through smart contracts, the real estate tokens are encoded with contract conditions, including potential dividend payouts. It means that dividends are also paid out automatically to the current asset owners within their specified timeframe, monthly, quarterly, or annually.

Vave offers a list of potential real estate investments with monthly revenue. You can track, manage, and monitor the income from your investment via the Vave dashboard and wallet. We offer quick and secure payouts in crypto and fiat, and the most lucrative investment locations in top cities around the world, including New York, Paris, and Amsterdam.

For house owners, we provide the complete real estate tokenization process with easy and automated steps. Get in touch to find out how to tokenize your property in San Francisco, Paris, Toulouse or any other part of the world.

English

English  French

French