Dear Reader,

For some, invest in real estate:

- Is too expensive

- Takes too long

- And good deals are reserved for insiders.

So I propose to do a little exercise. Find a good deal in less than 10 minutes:

- Cheap

- Easy (ie without work and already rented)

- And all alone on the Internet

Let’s see if it’s possible…It is 03:30 am when I write these lines.

Let’s go.

I go to a classifieds site. I’m looking for real estate. I must have finished my research at 03:40 am. Then I will write the result below.

03:39 am. Here is the result :

Property 1: apartment

The first to be released is an apartment of 63 m2 renovated (the photos are pretty), with a garden, rented 545 euros per month (no charges), and for sale 45,000 euros to discuss.

Property tax: 500 euros.

The net profitability before negotiation is therefore:

(((545 x 12) – 500) / 45,000) x 100 = 13.40%.

For me, that remains to be studied, but by making an offer at 37,500 euros, for example, profitability climbs to more than 16%. For a loan including notary fees, the monthly payment over 20 years would be 202 euros for a rent of 545 euros…

Or more than 300 euros of profit per month, even after deduction of the property tax. But the apartment is located 7 minutes from a city of 40,000 inhabitants located in the Gard.

And I know some readers will say that it’s too small, that there might be few requests. But when we see that even by dividing the rent in half, the property is self-financing…

However, let’s see if there is something else.

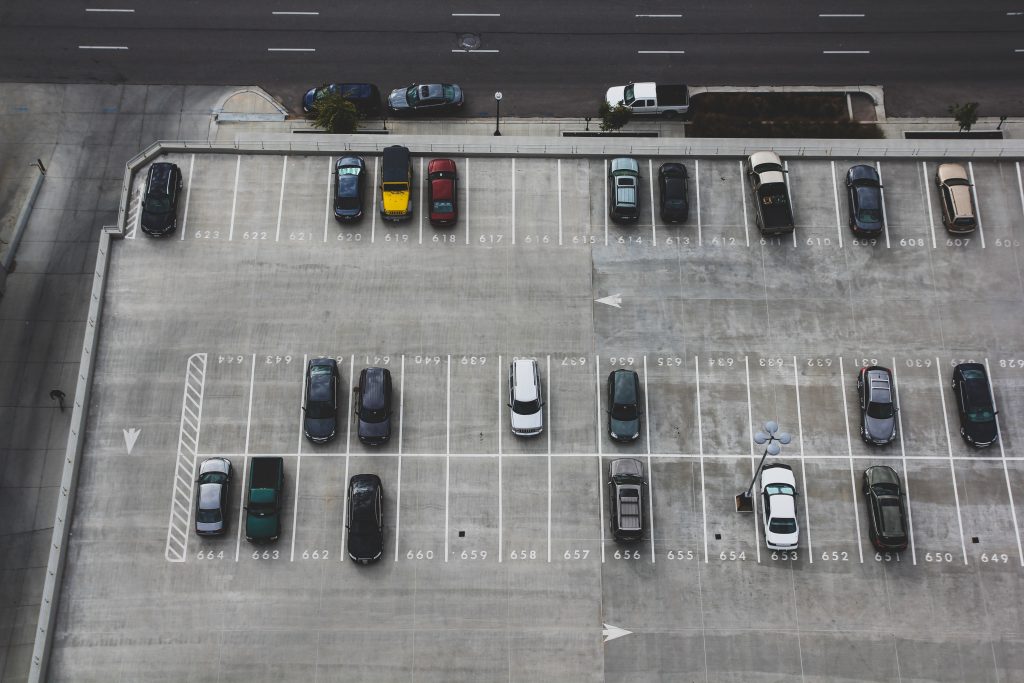

Property 2: a lot of garages

Then I find it… well! A lot of garages (I love garages).

Lot of 18 garages located just next to Rouen. They are all rented, 50 euros per month. Property tax, 1,200 euros. Sale price 120,000 euros. The whole is tarred and in very good condition. Profitability:

(((50 x 12 x 18) – 1,200) / 120,000) x 100 = 8%.

For a person who has managed to put 9,000 euros aside to pay the notary fees, the credit over 20 years will be 607 euros for a rent of 800 euros, property tax deducted.

So a lot of garages that pays for itself and that generates 200 euros of profit per month. Knowing that for garages, there is almost never any work, even less clogged toilets …

Over the years, the rents will increase, the 200 euros will become 250 then 300. Yes, even in the event of a temporary crisis. And the day the credit ends, it will be at least 800 euros per month that the buyer will cash.

A great retreat for something found in less than 5 minutes.

Not?

Property 3: garage

I can already hear readers complaining: “yes, but I live in Paris …”.

Large boxable parking space (that is to say, it is possible to put concrete blocks and a door to make it a “closed” property and thus increase its value), rented 150 euros per month, for sale 17,000 euros in Paris, 19th arrondissement.

There is no detail of charges or property tax; however, in Paris, the property tax is very low. Here, it’s worth making a phone call to find out and make an offer.

We are still at more than 10.50% profitability in Paris. How much is booklet A already? 0.75%. All is said…

Property 4: commercial premises

Any last for the road?

Commercial premises in Corbeil-Essonnes. Leased for three years 565 euros excluding charges. Property tax payable by the tenant (as is very often the case for commercial premises).

Sale price 82,000 euros. Profitability: 8.50% net. Not a bad deal knowing that for commercial premises, the work is often, like the property tax, chargeable to the tenant.

However, for this room, I would make an offer well below. But, as it stands, this property is largely self-financing.

Here! I found these four properties in 10 minutes and in a few clicks. So imagine what you can find by doing real research.

Of course, you have to know the place, check the numbers, ensure demand, prices per square meter. But I want to show some people who say right away that everything is impossible that, no, things are possible.

There will always be pessimists, spoilers. But someone who knows their sector and who is on the lookout for a good deal will find it sooner or later. Do not listen to those who never do anything. Train, watch for the right deal, then go for it. What do you risk after all?

Once you have succeeded, the same people will tell you that “you were lucky”, that “now this is no longer possible”. It is possible, and it always has been. But at all times, there are people who do nothing and spend their time discouraging others.

To start, the first step is to surround yourself with positive people by becoming a member of vave.io.

It is possible, and it always has been. But at all times, there are people who do nothing and spend their time discouraging others.

To start, the first step is to surround yourself with positive people by becoming a member of Vave, company which I founded and which would have saved me years if it had existed in my early days.

CLICK HERE to discover the presentation page.

English

English  French

French